Time in the Market is More Important than Timing the Market

Investing can be an emotional process, especially if you try to time the market. The “what ifs” can be overwhelming, leading to missed opportunities in the market. A strategy that can help you overcome this challenge is dollar cost averaging. You can invest a fixed amount of money at predetermined intervals over an extended period. A dollar cost averaging strategy allows you to automatically buy more units when the price is low and fewer units when the price is high.

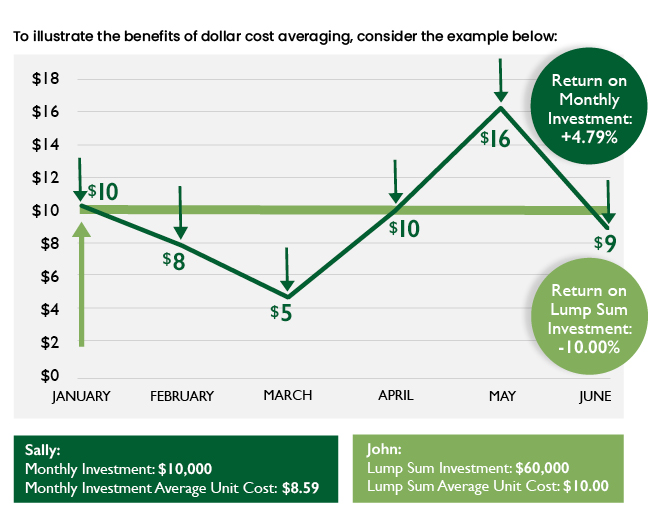

To illustrate the benefits of dollar cost averaging, consider the example below:

- Sally, a concerned investor, has $60,000 to invest into a mutual fund. Her advisor suggests spreading out her investment over 6 months to equal amounts of $10,000. Throughout those 6 months, the unit price is up some months and down in others. The chart above shows how Sally uses dollar cost averaging to benefit from the market's volatility over this period and grow her investments.

- Now assume John invests in the same mutual fund but is less cautious and places $60,000 as a lump sum investment in January. He makes no other additional investments or withdrawals from his mutual fund for the next five months and, therefore, does not take advantage of the declines in the price. The chart shows how John would have fared over this same period.

- Sally’s return on her monthly investment using a dollar cost averaging strategy is a gain of $2,875, or 4.79% and at the end of the period she owns 6,986 units, whereas John’s return on his lump sum investment is a loss of $6,000, or 10% and he owns 6,000 units.

Here are three reasons why dollar cost averaging matters:

1. Consistency

Your overall returns will reflect the general trend in the investment’s performance, rather than the specific price from one day.

2. Reduced risk

Instead of having to invest a large lump sum at once, you can periodically invest smaller amounts over a longer period.

3. Long-term mindset

It enables you to stick to a long-term investment mindset, rather than focusing solely on daily price changes.

A dollar cost averaging strategy lets investors make investments at regular intervals, regardless of the price, to average out the cost of their purchases over time.

Investing in Uncertain Times: The Case for Dollar Cost Averaging

We are experiencing a very different market than the previous 10 years. Higher interest rates, which are intended to combat inflation, are weighing on companies and consumers. Dollar cost averaging allows you to invest regularly without worrying about what’s happening in the market. It also provides the following benefits:

- Having an automatic plan in place increases the opportunity for you to buy at good times, as it is difficult to predict when those entry points will be.

- A disciplined approach to entering the market can reduce risk by not putting all your eggs in the basket at the same time.

The Results of Consistency

Implementing a dollar cost averaging plan will help you avoid emotional reactions to market swings by automatically investing your money regardless of day-to-day changing conditions. It also reduces volatility by averaging out your investment costs over time. Overall, having a dollar cost averaging plan in place reinforces the importance of maintaining a long-term mindset when investing.

If you'd like to view this article in a PDF, click here.